A Deep Dive Case Study of Enterprise AI in Action: Klarna’s Bold Bet on Automation

Turning AI from a buzzword into a workforce, Klarna is proving that automation isn’t just about efficiency—it’s about reimagining how business gets done.

Over the past three years, Swedish company Klarna has pioneered the use of AI to enhance the online shopping experience, and it has also been one of the first firms to use the same technology internally to replace labour, reduce costs and become more efficient.

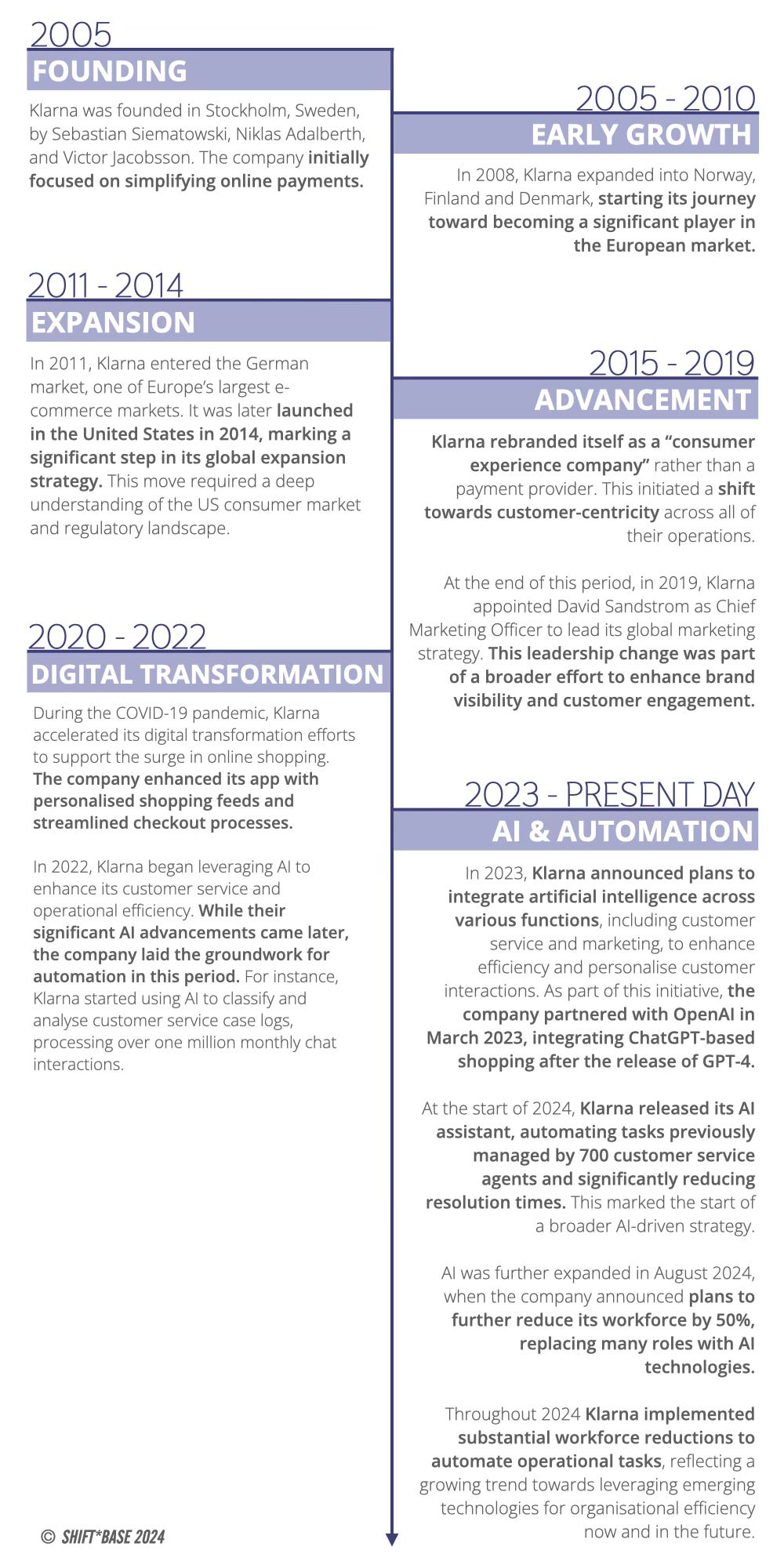

Founded in 2005, Klarna initially focused on improving and simplifying the e-commerce experience for customers in Sweden, then Scandinavia, Germany and (in 2014) the United States. The realisation that check-out and fulfilment processes created friction in the purchase experience led to the application of AI to make instant credit decisions that would enable retailers to offer buy-now-pay-later (BNPL) purchases online whilst minimising risk of non-payment.

Now, as one of the first companies to openly embrace the replacement of human workers with AI agents and processes, Klarna gives us an insight into the future of work and organisations in the AI era.

Founder and CEO Sebastian Siemiatkowski recently announced that AI is handling the workload of approximately 700 employees, and that all teams are incentivised to find more opportunities for automation. Klarna isn’t just rewriting the fintech rulebook; it’s reinventing what work looks like in the age of AI.

AI-driven chatbots answer questions in seconds. Generative AI helps create marketing campaigns faster than ever. Even an AI-powered avatar delivered the CEO’s message in a recent earnings call.

These headline-grabbing moves aren’t just stunts. They reflect a deeper question every organisation must face: can AI deliver real, sustainable value without losing the human touch (and where is it most needed?) Klarna is walking a tightrope—balancing innovation with impact, bold moves with cultural change in a market with slim margins and lots of tail risk.

In this case study, we shall unpack how Klarna is navigating this razor’s edge: the wins, the challenges, and the lessons it offers for organisations ready to embrace transformation at scale.

But this case study obviously poses wider questions as well.

In highly process-driven customer service contexts, is it better to employ people to follow the script and act like robots, or should we go all the way and use bots for most cases, with human oversight and exception handling for the edge cases?

In Fintech and other areas of the online economy, should we think of organisations as process machines that can operate almost entirely autonomously, and if so, how do we fulfil the duty of care in areas such as BNPL where there is the possibility for debt traps and social harms?

Coming from a C20th world where your job conferred identity, and possibly meaning, in addition to sustenance, what are the implications of breaking the link between work and income? And just how much work could or should be automated before societies have addressed the question of how people thrive without traditional jobs.

If AI-driven automation can remove significant costs from company operations, who captures that value and how does this change the way companies contribute to social funding through payroll and income taxes?

Any case study of a work in progress should be treated with caution, but leaving aside the big questions and judgements about Klarna’s embrace of automation, there is already a lot to learn for leaders who want to explore similar approaches within their own organisations, whether at the customer interface or internally within business operations. So let’s dig in.

Pushing Boundaries and Raising Eyebrows

Klarna isn’t just keeping up with the competition—it’s flipping the script on what a fintech company can achieve with AI. Operating across 45 markets, serving over 150 million active users, and working with 500,000 merchant partners, Klarna is reshaping the payments landscape. In 2023 alone, the company facilitated more than $100 billion in transactions, cementing its position as a global powerhouse.

What’s driving this growth? Klarna’s fearless embrace of AI, which is transforming how it serves customers and operates behind the scenes. Here’s what they’ve been up to:

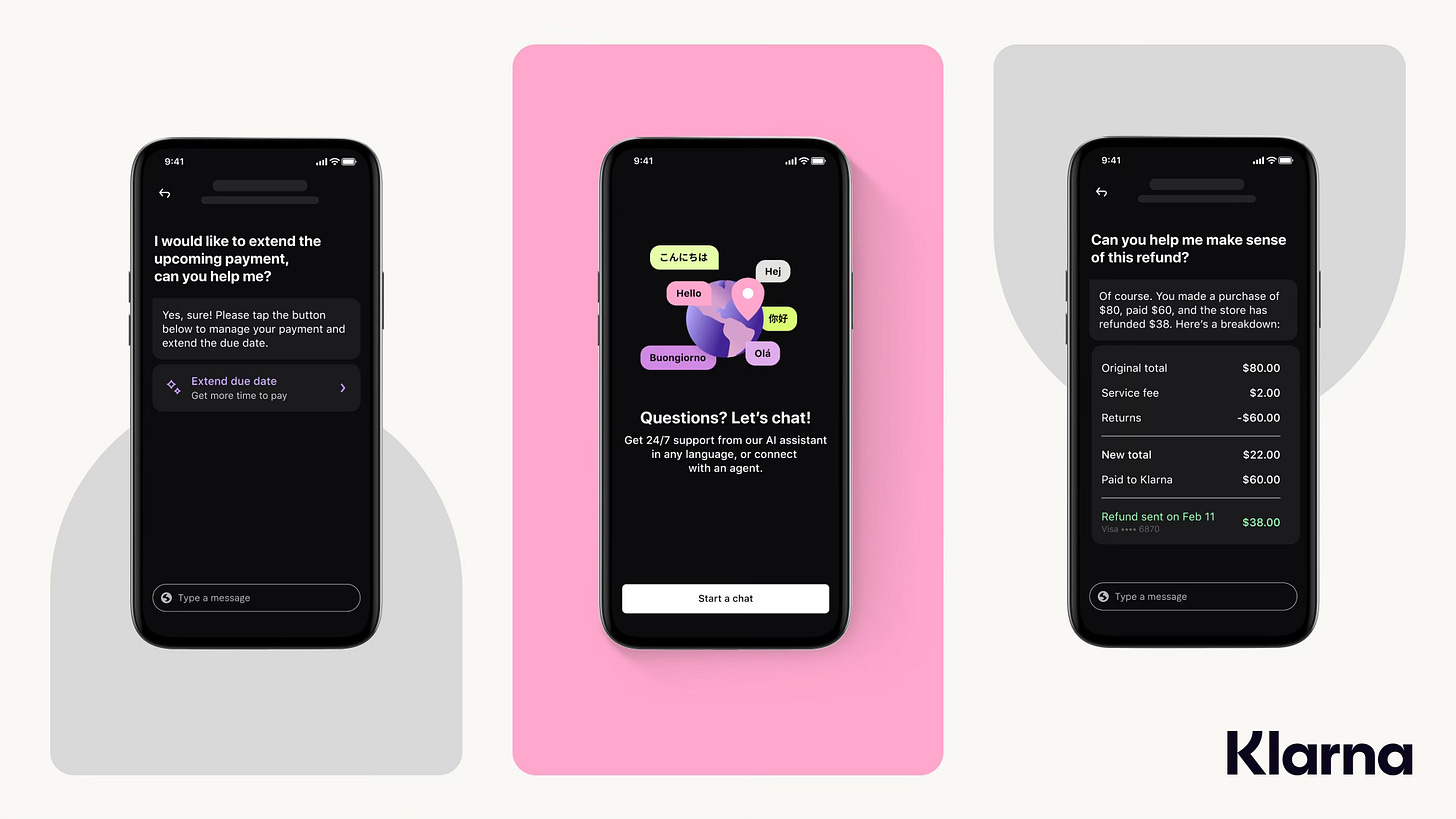

Customer service, reimagined: Klarna’s AI assistant now handles two-thirds of customer interactions, cutting response times from 11 minutes to under 2 minutes—and saving $40 million annually.

AI for teams: The internal AI assistant, Kiki, provides instant access to knowledge, speeding up decision-making and boosting productivity across teams.

Marketing, accelerated: Generative AI tools have slashed campaign timelines from six weeks to just seven days, delivering personalised ads that resonate—while saving $10 million a year.

A smarter shopping experience: AI-powered tools like shoppable videos and a shopping lens make finding products as easy as snapping a picture or scanning a barcode.

This isn’t just about efficiency—it’s about redefining what’s possible in fintech. Klarna’s approach doesn’t just automate processes; it rethinks them, combining the best of technology and human insight to deliver exceptional results.

For Klarna, AI isn’t just a tool—it’s the engine driving its bold vision for the future of finance.

Key Building Blocks of Klarna’s Success

Klarna’s AI revolution didn’t happen by accident. Beneath the flashy headlines and jaw-dropping results lies a carefully constructed foundation. It’s not just about deploying cutting-edge tools—it’s about creating an environment where bold ideas can thrive and scale. So, what’s Klarna’s secret sauce?

Unified Data Infrastructure: Klarna brings together data from 45 markets, turning a torrent of information into a reliable stream of actionable insights. This backbone fuels real-time decision-making and powers its AI at scale.

Advanced AI Technology: From natural language processing to machine learning, Klarna has invested heavily in high-impact tools. Whether it’s Kiki, the internal AI assistant, or its customer service chatbot, these systems don’t just work—they deliver.

Culture of Experimentation: Klarna’s teams live by the “fail fast, learn faster” mantra. By encouraging quick experimentation and rapid scaling of what works, Klarna stays nimble in a fast-moving market.

Customer-First Mindset: Every AI innovation at Klarna is designed to solve real problems—whether it’s helping shoppers find the perfect product or resolving customer queries in seconds.

Strategic Partnerships: Klarna’s collaborations with AI leaders, research institutions, and its merchant network give it access to the latest tech and expertise, keeping it ahead of the curve.

None of this happened overnight and Klarna has been laying the groundwork for years:

In 2021, early experiments with AI-powered chatbots set the stage for today’s sophisticated customer service assistant.

By 2022, Klarna was using data-driven AI tools to personalise marketing campaigns, slashing costs and timelines.

In 2023, it rolled out a unified global data platform, accelerating the adoption of AI across its operations.

This mix of strategy, culture, and technology is what separates Klarna from the pack. It’s not just adopting AI—it’s embedding it into the company’s DNA, creating a future-ready business that’s as bold as its vision.