Risky Business: Harnessing AI for Smarter Risk Management

Learn how to leverage AI for real-time, proactive risk management that keeps your organisation ahead of emerging threats.

This week, we showcase an important digital business capability that will be transformed by enterprise AI, and break it down to show how you can implement this in your own organisation: an AI-driven risk management service.

In most risk management today, there are two key problems:

a lack of risk model granularity, so we can vary our approach based on how impactful a risk might be. See our case study on WL Gore for a good example of a more grown-up and granular risk management approach that does not inhibit innovation quite so much; and,

too much focus on known, quantifiable risks, but a lack of visibility of emerging or unknown risks that might, in fact, be identifiable in data.

In an era where risks evolve faster than the strategies designed to mitigate and manage them, traditional risk management methods are no longer fit for purpose. Rather than react to risks as they arise, relying on static models and historical data, we need an anticipatory risk management approach — one that doesn’t just react to risks but foresees them, models their potential impact, and prescribes actions before they disrupt operations.

How can we use AI tools to make this possible?

Risks emerge from multiple sources—cyber threats, regulatory changes, geopolitical shifts—making a reactive approach insufficient. In the absence of data visibility, senior leaders are often left to make critical decisions based on outdated or incomplete information.

AI-driven risk management, on the other hand, harnesses the power of real-time data, machine learning, and predictive analytics to create a proactive, adaptive framework. By leveraging AI, organisations can identify risks earlier, predict their potential impact with greater accuracy, and prescribe strategic responses before risks escalate into crises. For the C-suite, this shift isn’t just about mitigating risk—it’s about transforming risk into a strategic advantage, allowing organisations to be more agile, informed, and prepared for the future.

This capability directly addresses the following challenges:

Uncertainty and Volatility: AI’s predictive capabilities offer organisations a way to forecast emerging risks across dynamic, volatile markets, allowing for proactive mitigation strategies.

Operational Resilience: AI can simulate risk scenarios and assess potential impacts, ensuring that organisations can make faster, more informed decisions in high-risk situations.

Cross-Functional Collaboration: AI democratises risk insights across departments, transforming risk management from a siloed function into a collaborative, organisation-wide responsibility.

AI-driven risk management provides the C-suite with the tools to turn unpredictability into opportunity, enabling a future where risks are identified, assessed, and managed in real-time. This isn’t just about responding to risk; it’s about anticipating it and building a resilient, forward-thinking organisation.

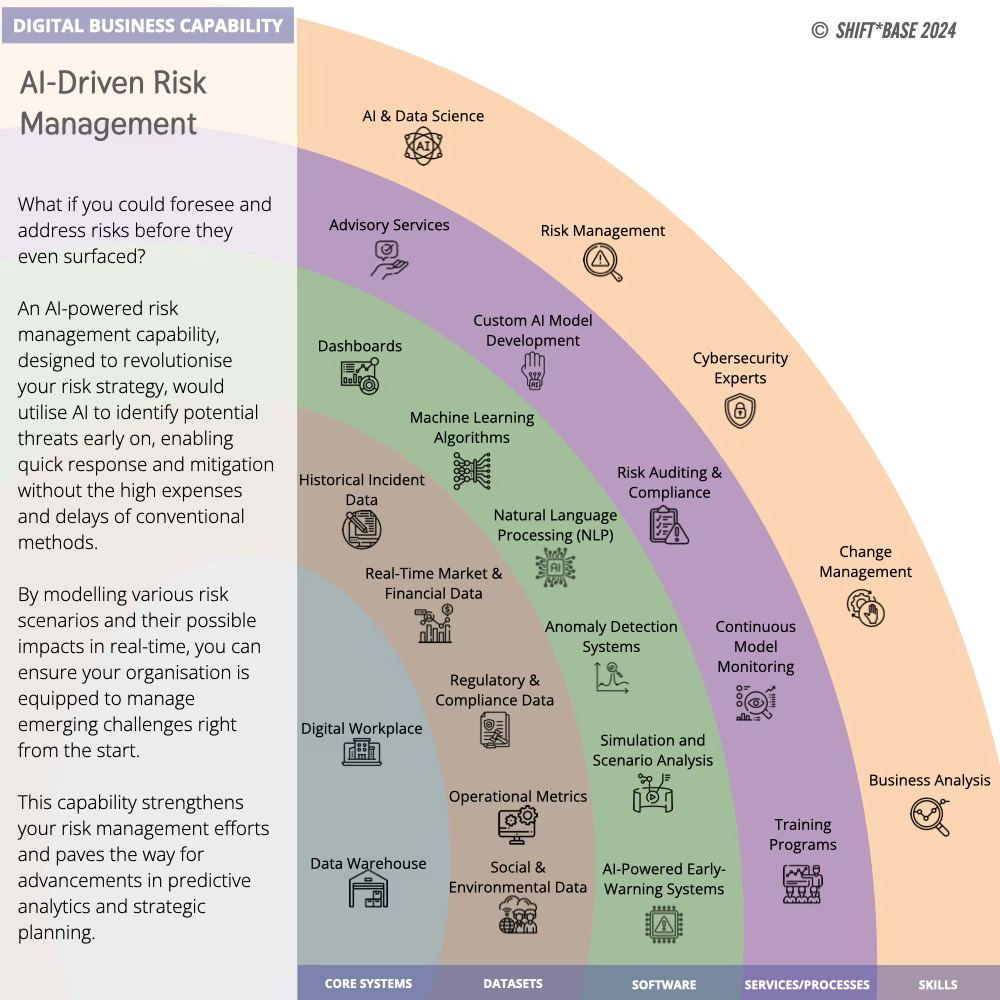

Identifying Key Components

Every digital business capability can be broken down into the ingredients and components needed - like a recipe - to help answer the following key questions:

What components does the organisation already have in place, and which are missing?

What related new technologies or initiatives are already planned?

What services - and therefore skills - need an upgrade or re-training?

Expected Benefits

Developing an AI-driven risk management capability offers advantages that extend across operational, strategic, and financial domains. Organisations that leverage AI in risk management use cases can expect not only a reduction in the frequency and severity of risks, but also a strengthened ability to respond dynamically in uncertain environments.

Key measures of success include:

Improved Risk Detection and Forecasting: AI models can process vast amounts of internal and external data in real time, identifying emerging patterns and anomalies that may signal future risks. Measuring improvements in early warning indicators and the accuracy of risk predictions will demonstrate the enhanced foresight AI provides.

Enhanced Decision-Making Under Uncertainty: AI’s capacity to simulate multiple risk scenarios allows decision-makers to better understand potential outcomes and impacts. This enables faster, more informed decisions, even in complex or volatile environments. Tracking decision-making speed, particularly in high-risk situations, will illustrate the value AI adds in increasing organisational agility.

Reduction in Financial Losses from Risk Events: AI-driven risk management significantly reduces the occurrence of risk events and mitigates their financial consequences when they do arise. By leveraging predictive insights, companies can pre-emptively allocate resources or adjust strategies, reducing the direct and indirect costs of disruptions. Monitoring the reduction in risk-related financial losses over time will serve as a clear measure of the AI system’s effectiveness.

Optimisation of Risk Management Processes: AI streamlines the process of risk identification, assessment, and mitigation, enabling continuous monitoring and adjustments as new data emerges. This leads to faster, more efficient risk management cycles. Improvements in key performance indicators, such as the time to assess and respond to risks, will quantify the operational efficiencies gained.

Increased Regulatory Compliance and Reporting Accuracy: With AI’s ability to track and report on compliance in real time, organisations can ensure they remain aligned with regulatory requirements, avoiding penalties and reputational damage. AI-driven automation of risk reporting ensures that reports are timely, accurate, and reflect the latest risk data. Metrics such as compliance audit outcomes and the accuracy of reporting can be used to assess these improvements.

Empowering Risk Teams: By automating routine risk assessments and monitoring tasks, AI frees up risk professionals to focus on strategic, high-value activities. Measuring changes in employee productivity, engagement, and the time spent on value-adding tasks will provide insight into how AI is enhancing the risk management function and workforce satisfaction.

Read on for a guide to getting started with AI-enhanced risk management services.