The key role of the digital workplace in supporting successful M&A integration

In this issue, Livio considers the cultural elements of M&A integrations and how they can be enabled by a purposeful digital workplace strategy

Big is not always beautiful

Last year was dubbed “the year of M&A” due to the huge number and value of transactions taking place in that period: $5.9 trillion across 63,000 transactions, representing an increase of 64% and 24% percent respectively on pandemic-stricken 2020. This is a *huge* amount of activity and although levels have dropped in 2022 YTD due to ongoing market turmoil, they remain on course to to hit roughly pre-pandemic levels, based on recent McKinsey estimates.

Market timing issues aside, the appetite for M&As - fuelled by still pent-up investment cash - remains at an all-time high, despite a staggeringly high level of integration failures, which Clay Christensen et al. estimated at around 70-90% back in 2011. Failure levels have since dropped slightly, but are still sitting at more than two-thirds. Given the large sums involved, and how these transactions affect millions of workers, it is hard to fathom why more attention is not paid to the possible causes of M&A integration failure and how to improve such dismal success rates.

People & culture

The sheer complexity of integrating two businesses to become a better one is undoubtedly at the core of many integration failures. However, a lack of focus on people factors is also a very significant factor. This is not simply due to the transactional nature of much post-M&A activity, which prioritises finance, technology, sales systems and efficiencies, first and foremost. In this view, while ‘people synergies’ are always part of an integration’s stated aims, they are largely an exercise in moving people around the NewCo’s paper structure, discarding duplicates and retaining those that appear to fit the merged entity, which is not always an improvement. For example, in a recent PwC survey,

“83% of companies who say significant value was destroyed in their latest acquisition lost more than 10% of key employees following the transaction”

This resonates with our personal experience, which taught us that just throwing employees under a transformed leadership layer, without addressing the concerns and frustrations generated by a much-changed corporate culture, is a huge part of the post-integration puzzle to be solved. Culture, it seems, is the key factor in getting different groups of NewCo people to gel and, eventually, move in the same direction. But if corporate culture is so important in making integrations work (and assuming it is not simply overlooked or ignored in merger planning), why is acting on this challenge so hard?

Part of the answer lies in this term's vagueness, and the fact that addressing human factors is notoriously hard. As with many other high-level corporate objectives, just stating them as ambitions is utterly pointless, without specific clarity on what they mean and how they can be broken down into actionable elements. Each company is different, but I like to define culture by reference to the six factors listed by John Coleman in 2013, which still hold true today:

Vision, which can be stated as NewCo’s mission and purpose, to serve as the flag that all employees can rally around in times of doubt.

Values, to provide a set of guidelines on the behaviours and mindsets needed - and indeed, expected - to achieve the vision.

Practices, ranging from how people work and communicate to who they serve and how leaders are expected to behave.

People, meaning ensuring that our hiring, development and retention activities are closely aligned to the vision, values and practices.

Narrative, to explain NewCo’s origin story, either formally or informally, but always in an evocative and engaging way.

Place, originally meaning the physical environment to facilitate all of the above, but which is far more nuanced in the age of hybrid work.

A digital lens on the issues

So how can the affordances of the digital workplace and digital ways of working help to advance, embed and encourage these components of a successful corporate culture? Lee’s 2014 post on this topic provides a tempting glimpse of how this could work:

“An obvious starting point would be to set up a common social platform and encourage people to begin getting to know each other and weaving connections within and between the social networks of the entities that are merging [...]. Let people find each other, talk and share from day one and all other challenges will be easier to address.”

Indeed. But to be more specific, a properly implemented and adopted social platform can facilitate and accelerate what I like to think of as the ‘four Cs’ of a successful digital workplace:

Capabilities, i.e. learning and practicing the mindsets, competencies and skills needed by NewCo to succeed.

Collaboration, nominally what all digital workplace platforms are designed to promote, but which requires specific orchestration to go beyond simple tools adoption.

Community, which acts as a powerful accelerator of NewCo’s employee connections, knowledge sharing and sense-making - from traditional communities of practice through to the promotion of stronger social bonds.

Communication, which the digital workplace brings to greater human-scale and interactive heights, compared with traditional top-down announcements and merger FAQs on static intranet pages.

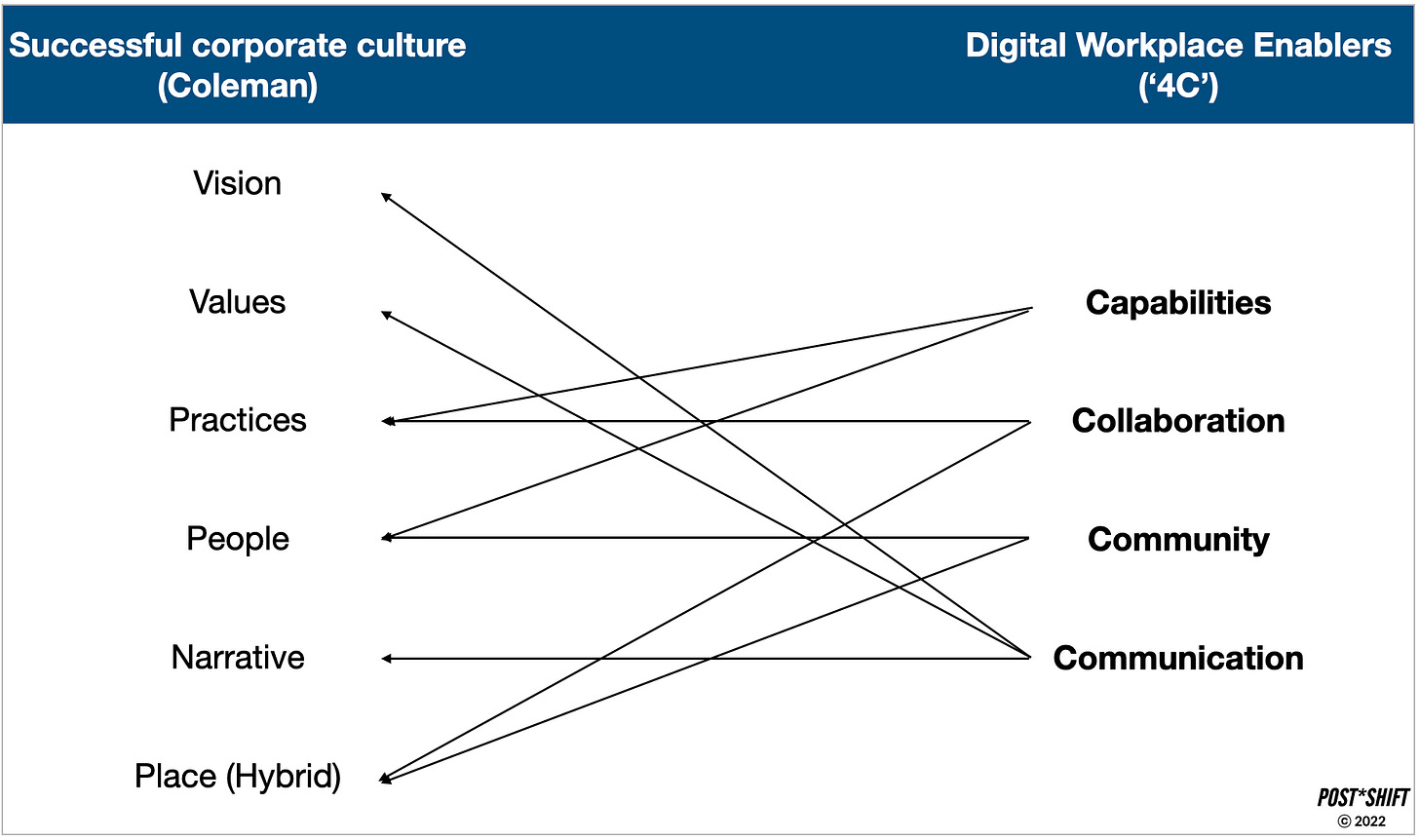

When viewed through a digital lens, Coleman’s cultural success elements and the digital workplace’s ‘four C’ enablers are easy to see as being connected and mutually reinforcing:

(This is not a comprehensive mapping - you could make a case for all components being linked to each other - but is a simple illustration of how closely these elements connect).

From the merger’s announcement until ‘Day 1’ of the integration proper, lack of visibility, connection, and the ability to see the human aspects of the ‘other’ party in an M&A transaction are huge risks to success.

A targeted, well-designed and creatively-executed digital workplace strategy will support the development of a positive corporate culture during complex M&A integrations and mitigate the very significant risk of failure deriving from a lack of focus on the people and cultural elements at play.